In the context of cryptocurrencies, Bitcoin mining emerges as one of the fundamental aspects underlying the functioning of this innovative form of digital currency. It is therefore crucial to understand the intricate details of this process, highlighting each of its aspects and its importance in ensuring the security and validation of transactions within the Bitcoin network.

The blockchain, the beating heart of the technology behind Bitcoin, is our starting point. Its nature as a distributed ledger, containing blocks of verified transactions, is the foundation on which the entire system is built.

At the heart of the protocol is the consensus mechanism known as Proof of Work (PoW). This fundamental process performs several functions and its repercussions are manifold, many of which may not be obvious at first glance.

First and foremost, it allows the correct alignment between all the nodes of the network to be maintained. In other words, it allows the distributed network to self-regulate fundamental aspects of its operation without a central element acting as coordinator.

In this process, miners are crucial figures as they engage in a competition based on the performance of demonstrable and verifiable work (hence the name 'Proof of Work'). The product of this work is a block of transactions that will be added to the top of the blockchain. This output is rewarded through the issuance of new bitcoins. These rewards constitute the minting of new bitcoins, the issuance of which is subject to a fixed and predictable rule called halving, which governs the currency's zero-trending inflation.

But this 'proof of work' is also fundamental to the integrity and immutability of the blockchain and thus guarantees the security of the system and the assets of its users. The security of Bitcoin is indeed analysable and provable. Although there are theoretical risk elements such as the[[51% attack]], the chances of their practical applicability are residual.

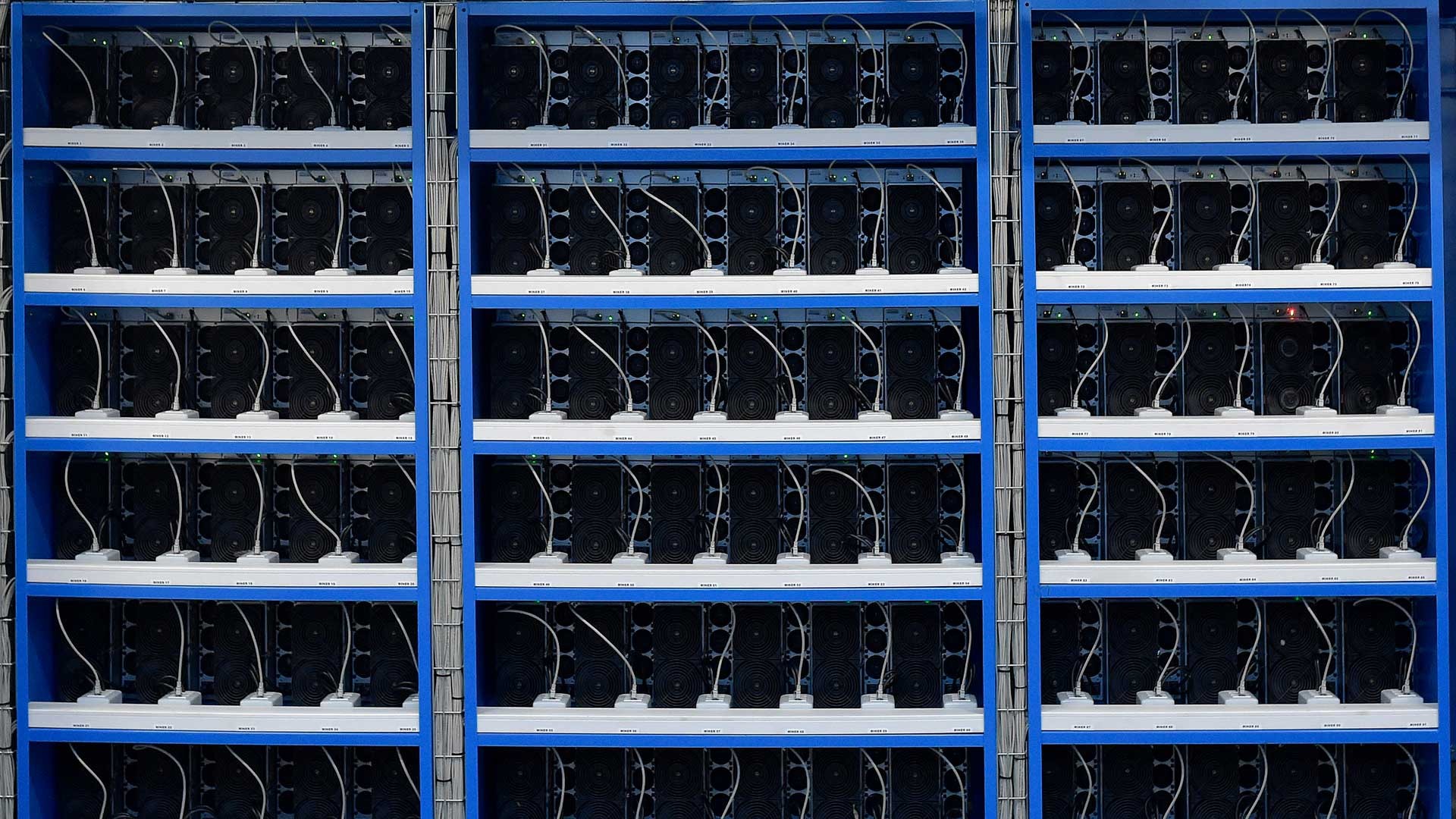

In all this, of course, technology and hardware play a key role. The competitive drive has led miners to express an unprecedented amount of work, or Hashrate. To reach these levels, considerable R&D effort was required to move from general purpose hardware to ASICs (Application-Specific Integrated Circuits). These advances have indirectly benefited chip production in every sector, including mobile phones, computers and artificial intelligence.

But technology alone is not enough. Whereas in the early days mining was something that could be done at home, today it is real listed companies that hold the main shares of this market. Huge investments and multinational-style managerial and financial management are required. Among the most popular financial strategies is the one whereby several miners collaborate in the creation of mining pools to share rewards in proportion to the hash power provided, improving the management of the incoming flow of rewards.

A phenomenon of this importance and complexity cannot, however, be without criticism. Of these, unfortunately, the most widespread is related to energy consumption, which is sometimes even confused with the environmental footprint of the network. These criticisms, however, are gradually being downplayed, and indeed Bitcoin mining is shown to be an advocate of renewable energy production and is crucial to maintaining the stability of electricity grids.